Scams on the internet are always changing. Each year, the National Consumers League examines the tens of thousands of consumer complaints sent to the Fraud site and makes those findings public in order to identify scam trends and serve as a tool for preventing fraud.

Con artists from all over the world are probably currently aiming for a computer or mobile device close to you. Here is a look at the most typical online scams and what you can do to protect your wallet and personal information.

Top 17 Internet scams

1. Fake Check or Money Transfer

You list something on a shopping site and the winning bidder offers to pay you more than the offered purchase price by cashier’s, corporate, or personal check. After getting the fake check from the fraudster, You are tricked into sending the difference back through bank wire. After the fraudulent check bounces, you must repay the bank in full.

Never accept payment for an item for more than it is worth. In order to avoid scams, you should choose a secure e-payment method like PayPal or Google Wallet.

2. Lottery Scam

Congratulations! You’ve won the lottery or some other large amount of money! However, you have not. This fraudulent email appears out of the blue and stresses that you have won big and that all you need to do is send a processing fee or get in touch with someone who can handle your winnings. It typically claims to be from an international sweepstakes.

Chances are you haven’t hit the jackpot unless you’ve played a real lottery. Instead of the retailer contacting you when you win the lotto, it is the other way around.

4. Pre-Approved Notice

You get a letter or email stating that you have been pre-approved for a bank loan or a credit card. This con may target people who are struggling financially because it guarantees rapid approval and alluring credit limits. The problem? When you sign up, a charge is due upfront. Although annual fees are something credit card companies do impose, you will never be asked to pay them when you apply.

In general, avoid offers that promise a “100% guarantee,” demand payment up front, or ask for cash, money transfers, or gift cards as payment.

5. 419 Fraud—Advance Fee Scam

The 419 fraud, also known as the Nigerian letter scam, is one of the most widespread online fraud, which you might have likely seen in your own inbox. The advance fee scheme takes its name after the section of the Nigerian criminal code that outlaws fraud.

The scammer will ask for advance payments or personal data in exchange for goods, services, money, or awards that they never deliver.

Scammers create compelling reasons for demanding money, such as paying fees or taxes, that appear legitimate.

To convince the victim, the scammer typically poses as a wealthy Nigerian or other West African family member and contacts the victim directly after the death of a loved one

They will seek to move a sizable fortune into your bank account and out of the country for safekeeping. In exchange for a sizable portion of their cash reserve, you must make tiny fee payments. They frequently demand payment through an international wire transfer. You should never provide your bank account information in response to such inquiries. For your financial safety, do not respond to these requests or volunteer your bank details.

6. Travel Scam

Even the most savvy of travelers can be tricked by scammers who publish attractive images on social media platforms like Pinterest, Twitter, and Instagram. Upon clicking the image, which tempts clicks with the promise of a free vacation or plane tickets, you will be prompted with the option to either fill out a survey full of personal information or expose your computer to covertly dangerous malware .

Check to see if the social network account you’re on is legitimate. From their separate web pages, all major airlines and travel websites provide direct links to their social media accounts.

7. Fake Antivirus Software (aka ‘Scareware’)

Ads and pop-ups for fake antivirus software attempt to convince you that your computer is infected with a virus (or several viruses), and that you can solve the issue by downloading their software. They do this in two different ways:

Fake antivirus software ads and pop-ups try to make you believe your computer is infected with a virus (or dozens of them) and that you can fix the problem by downloading their software. These scammers get you two ways:

• They gain access to your credit card information.

• They gain access to your computer. When you click the download link, you get a virus, malware, or ransomware instead of antivirus software.

Always be wary of ads and pop-ups that prompt you to take immediate action, or ones that are hard to close. Be sure to install, update, and use real antivirus software to reduce the risk of scareware.

8. Tech Support Scams

This type of scam typically occurs in the United States and other developed nations. In this scam, you get a call, email, or pop-up warning that your computer is infected (ask yourself how they know). The fraudster then;

• Prompts you to download an application that allows them to control your computer remotely;

• Downloads an actual virus or otherwise makes you believe that something is wrong; and

• Tells you they can fix the problem for a fee.

Search engine results are another idea to get in touch with you: Tech support fraudsters put a lot of effort into getting their websites to appear in search results online or they create their own advertisements.

These scammers frequently demand payment via a bank wire, gift card, or money transfer app.

If you allowed a scammer remote access to your computer, update your security program right away, do a complete scan, and remove whatever it finds. Change your user name and password as soon as possible if you shared them.

9. Fake Shopping Websites and Formjacking

Numerous fraudulent websites advertise “great deals” on popular brands. These websites frequently feature URLs that are similar of the brands they are replicating, such “Amaz0n.net.” If you purchase something from one of these websites, there’s a good possibility you’ll get nothing or a fake item in the mail.

Another retail fraud is formjacking. When a trustworthy retailer’s website is hacked, customers are forcibly driven to a fake payment page, where the scammer takes their personal and credit card information. Make sure the URL on the payment page matches the website where you were shopping in order to avoid falling victim to this scam. Cybercriminals may very slightly alter the URL—possibly by adding or removing a single letter. Before you enter your payment information, be sure to carefully review the URL.

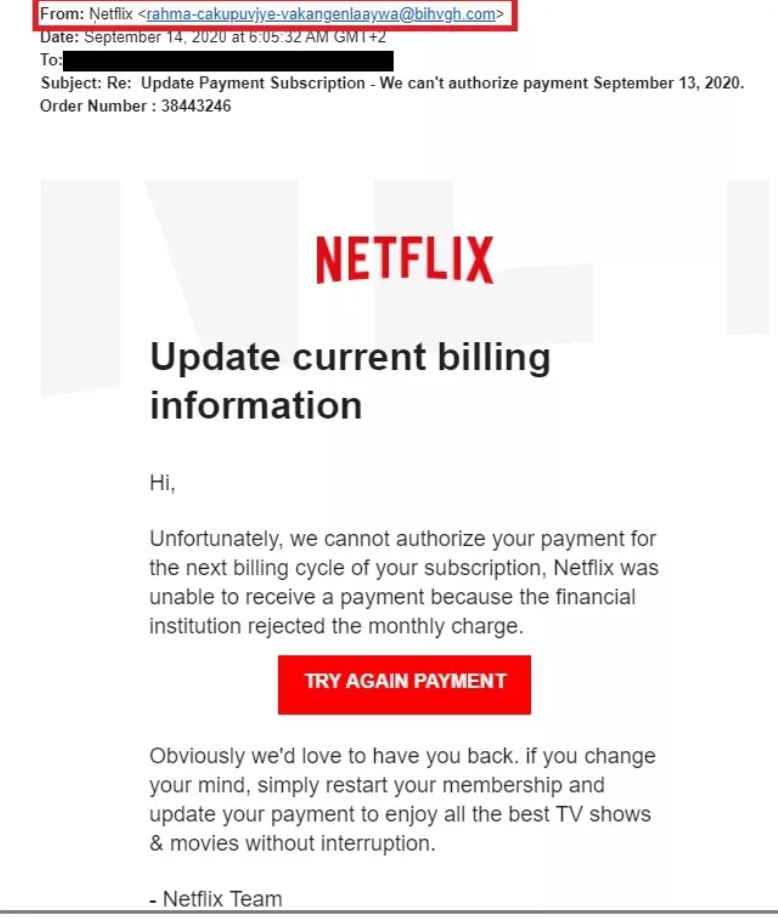

10. Phishing Scams

You get an email that appears to be from a well-known company that you trust, like your bank, university, or favorite retailer. The message sends you to a website, typically to verify personal data such as passwords and email addresses, where it steals your information and leaves your machine vulnerable to attack by scammers.

One of the most typical attacks on consumers is the phishing scam. The Federal Trade Commission claims that stories are regularly used in phishing emails and text messages to deceive recipients into clicking a link or downloading an attachment. For example, phishing attempts may;

• Say they’ve noticed suspicious activity or log-in attempts on your account

• Claim there’s a problem with your account or payment information

• Say you need to confirm or update personal information

• Include a fake invoice

• Ask you to click on a link to make a payment

• Claim you’re eligible to sign up for a government refund

• Offer a coupon for free goods or services

Never click the links in emails that you can’t independently verify. Your computer and personal information will be exposed to malware and viruses if you do so. Again, despite the fact that the sender may appear legitimate—exactly what the scammer wants you to think—no genuine organization will request your password or other important personal information online. Typographical or grammatical errors are commonly found in phishing emails, and the sender’s email address usually appears suspicious.

11. Dating and romance scams

On legitimate dating platforms, fraudsters create fake profiles.

They attempt to connect with you using these profiles in order to obtain your money and personal information.

The scammer will get to know you well before requesting money to cover expenses related to an accident, illness, trip, or family crisis.

Scammers try to prey on your feelings by appealing to your compassion. Sometimes it takes the scammers months or even years to establish rapport.

12. Banking, credit card and online account scams

In order to trick you, scammers send emails or texts that look like they came from your bank, a financial institution, or an online payment provider.

Typically, they allege that there is an issue with your account and ask you to confirm your information on a fake but convincing copy of the bank’s website.

The act of copying data from a credit card’s or an ATM card’s magnetic strip is known as card skimming.

Scammers install a covert attachment on an ATM or EFTPOS device to steal your card information. Even a camera installed to record your pin can be used.

Scammers can make replicas of your card after it has been swiped and charge your account.

13. Small business scams

If you own a small business you can be targeted by scams such as the issuing of fake bills for unwanted or unauthorised listings, advertisements, products or services.

A well-known example is where you receive a bill for a listing in a supposedly well-known business directory.

Scammers trick you to sign up by disguising the offer as an outstanding invoice or a free entry, but with a hidden subscription agreement in the fine print.

Scammers can also call your business pretending that a service or product has already been ordered and ask for payment over the phone.

14. Job and employment scams

These scams involve offers to work from home or set up and invest in a business opportunity. Scammers promise a job, high salary or large investment return following initial upfront payments.

These payments may be for a business plan, training course, software, uniforms, security clearance, taxes or fees.

These scams are often promoted through spam email or advertisements in well-known classifieds, including websites.

15. Golden opportunity and gambling scams

Scams often begin with an unexpected phone call or email from a scammer offering a not-to-be-missed high return or guaranteed investment in shares, real estate, options or foreign currency trading.

While it may seem convincing, in reality the scammer will take your money and you will never receive the promised returns.

Another scam promises to accurately predict the results of horse races, sports events, stock market movements or lotteries.

Scammers promise you huge returns based on past results and trends. In order to participate, you may be asked to pay for membership fees, special calculators, newsletter subscriptions or computer software programs.

16. Charity and medical scams

Scammers are unscrupulous and take advantage of people who want to donate to a good cause or find an answer to a health problem.

Charity scams involve scammers collecting money by pretending to work for a legitimate cause or charity, or a fictitious one they have created.

Often scammers will exploit a recent natural disaster or crisis that has been in the news.

They may also play on your emotions by claiming to collect for a cause that will secure your sympathy, for example to help sick children.

Medical scams offer a range of products and services that can appear to be legitimate alternative medicines, usually promising quick and effective remedies for serious medical conditions.

The treatments are often promoted using false testimonies from people who have been cured.

17. Disaster Relief Scams

Whether it’s a pandemic or a weather-related disaster, fraudsters are always present. Scammers will take advantage of a tragedy or natural disaster to defraud you of your money while disguising themselves as a legitimate help agency.

by believing you are making a donation to an emergency relief fund. By believing you are making a donation to an emergency relief fund, you unknowingly give credit card information or other e-payment information .

Donate only to reputable, well-established organizations. Before making a donation, visit GuideStar or Charity Navigator to verify the validity of any charitable organization you are considering supporting before you donate.

Although there are several additional ways that people are defrauded every day, the top 10 highlighted above are the most popular methods.

The Bottom Line

It’s reasonable to believe that you are being scammed if anyone asks for your bank or personal information. Never disclose personal information to anyone who contacts you directly on the internet. Make sure to use a safe server and a reliable website whenever you need to do a financial transaction online.

If you think you’ve been scammed, change all of your passwords right away, remove any dangerous software you may have downloaded, and contact your bank if necessary.