The hedge fund industry has produced some of the wealthiest individuals in the world. Forbes released its list of the top 10 richest hedge fund managers in 2023, showcasing their remarkable achievements and immense wealth. But before we delve into the list, let’s take a moment to understand what a hedge fund is.

What Is A Hedge Fund?

A hedge fund is a type of investment fund that pools capital from accredited individuals or institutional investors and employs various investment strategies to generate high returns. Hedge funds have more flexibility in their investment approaches compared to traditional funds and often aim to outperform the market.

Moreover, Hedge funds are typically managed by skilled and experienced fund managers who aim to outperform the market and deliver superior returns to their investors. These managers often employ complex investment strategies, including long/short equity, global macro, event-driven, and quantitative trading, among others.

Hedge funds often charge performance fees, which means that the fund manager receives a percentage of the profits generated, in addition to the management fees. This fee structure aligns the interests of the fund manager with those of the investors, as it incentivizes the manager to generate positive returns.

Now, let’s explore the top 10 richest hedge fund managers in 2023 and learn more about their impressive achievements and contributions to the industry.

The Top 10 Richest Hedge Fund Managers In 2023

10. David Shaw – D.E. Shaw & Co.

- Net Worth: $7.9 billion

- Source of Wealth: Hedge fund management

- Date of Birth: March 29, 1951

- Country: United States

David Shaw, a former computer science professor, founded D.E. Shaw & Co. in 1988. The firm manages over $60 billion in assets and is known for its sophisticated mathematical modeling and algorithms. Shaw’s contributions to the industry remain significant, despite reducing his involvement in day-to-day operations.

9. Chase Coleman – Tiger Global Management

- Net Worth: $8.5 billion

- Source of Wealth: Hedge fund management

- Date of Birth: June 14, 1975

- Country: United States

Chase Coleman founded Tiger Global Management in 2001. While the firm experienced a setback in 2022, it boasts an impressive track record with an annualized net return of 21% in its hedge fund. Tiger Global has recently shifted its focus towards venture funds, making its presence felt in the tech market.

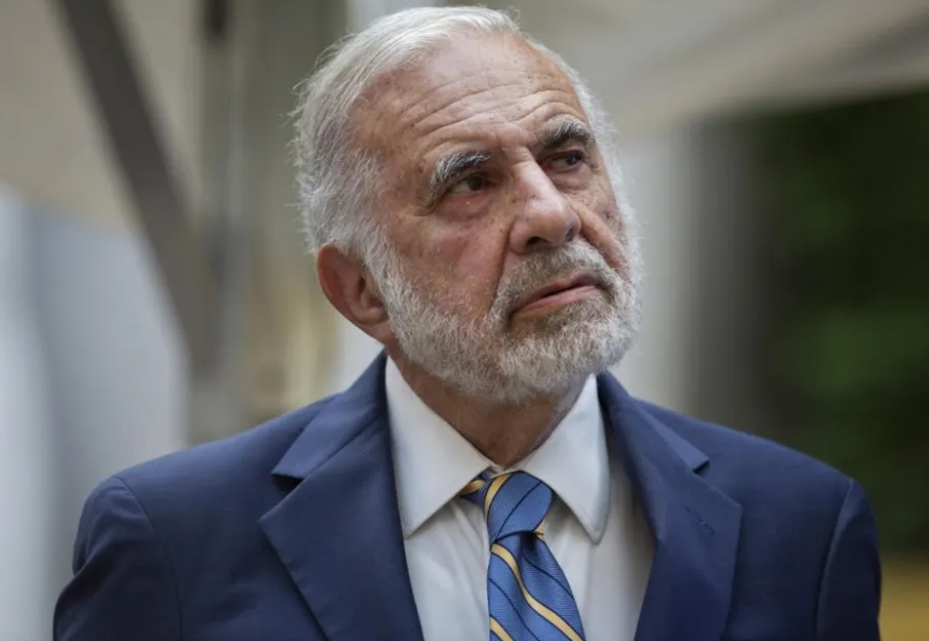

8. Carl Icahn – Icahn Enterprises

- Net Worth: $10 billion

- Source of Wealth: Activist investing, hedge fund management

- Date of Birth: February 16, 1936

- Country: United States

Carl Icahn, an activist investor, has left a significant impact on corporate America. His primary investing vehicle, Icahn Enterprises, has experienced steady growth. Icahn’s strategic investments and involvement in proxy battles have solidified his position as one of the most influential figures in the industry.

7. Israel Englander – Millennium Management

- Net Worth: $11.3 billion

- Source of Wealth: Hedge fund management

- Date of Birth: 1948

- Country: United States

Izzy Englander founded Millennium Management in 1989 with $35 million. The firm now manages $58 billion in assets, and its main multi-strategy fund consistently delivers impressive returns. Englander’s strategic investments and management have solidified his position as one of the industry’s most successful figures.

6. Michael Platt – BlueCrest Capital Management

- Net Worth: $16 billion

- Source of Wealth: Hedge fund management

- Date of Birth: December 12, 1968

- Country: United Kingdom

Michael Platt, the co-founder and CEO of BlueCrest Capital Management, transformed the firm into a family office after returning money to outside investors. Since then, BlueCrest has flourished, generating remarkable returns, including a 95% net return in 2020 and 153% in 2022.

5. Steve Cohen – Point72 Management

- Net Worth: $17.5 billion

- Source of Wealth: Hedge fund management

- Date of Birth: June 11, 1956

- Country: United States

Steve Cohen, the founder of Point72 Asset Management, manages $27 billion in assets. After a two-year supervisory ban, Cohen’s firm started managing outside capital in 2018. Cohen’s passion for sports led him to acquire the New York Mets baseball team for $2.4 billion in 2020.

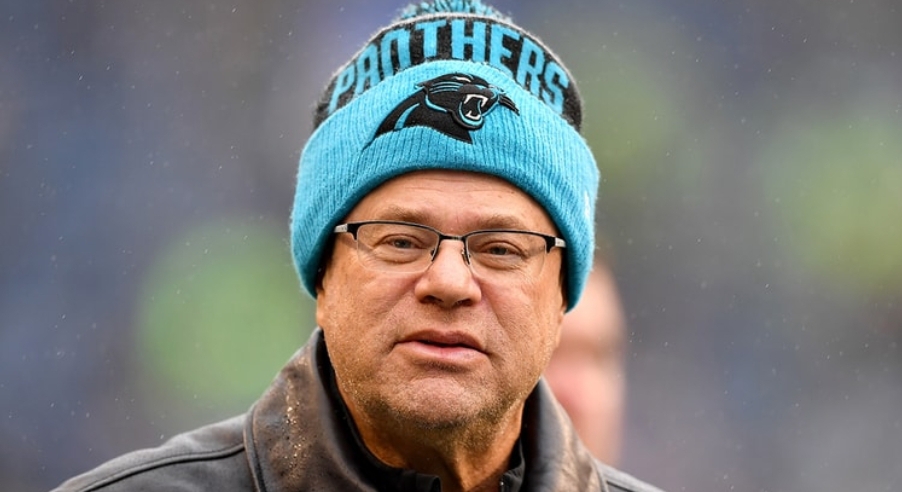

4. David Tepper – Appaloosa Management

- Net Worth: $18.5 billion

- Source of Wealth: Hedge fund management

- Date of Birth: September 11, 1957

- Country: United States

David Tepper, running Appaloosa Management, has delivered impressive returns over the years. With $14 billion in assets, Tepper now operates Appaloosa as a family office. He also made headlines by purchasing the NFL’s Carolina Panthers for $2.3 billion in 2018.

3. Ray Dalio – Bridgewater Associates

- Net Worth: $19.1 billion

- Source of Wealth: Hedge fund management

- Date of Birth: August 8, 1949

- Country: United States

Ray Dalio, the founder of Bridgewater Associates, turned his two-bedroom apartment into the world’s largest hedge fund firm. While he retired from key positions, the firm manages $124 billion in assets. Dalio’s contributions to the industry have been significant, making him one of the most influential hedge fund managers.

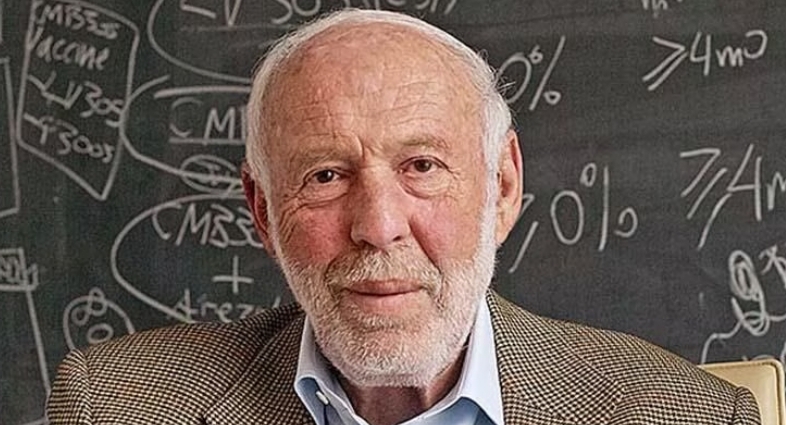

2. Jim Simons – Renaissance Technologies

- Net Worth: $28.1 billion

- Source of Wealth: Hedge fund management, mathematics

- Date of Birth: April 25, 1938

- Country: United States

Jim Simons, with a net worth of $28.1 billion, founded Renaissance Technologies, a renowned quantitative trading firm. The firm’s Medallion Fund, a $10 billion black-box strategy, has achieved remarkable success, averaging a staggering 66% annual return from 1988 to 2018.

1. Ken Griffin – Citadel

- Net Worth: $34.6 billion

- Source of Wealth: Hedge fund management

- Date of Birth: October 15, 1968

- Country: United States

Ken Griffin tops the list as the wealthiest hedge fund manager with a net worth of $34.6 billion. Citadel, his multi-strategy firm, manages $57 billion in assets and has consistently outperformed its peers. Griffin’s market-making firm, Citadel Securities, handles over 25% of all U.S. stock trades.