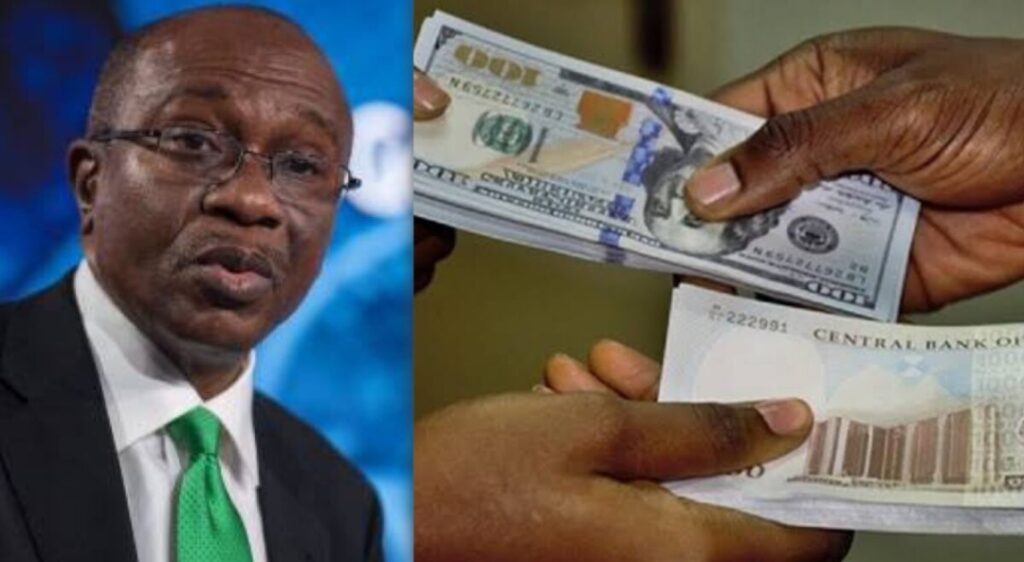

In a dynamic financial landscape, today’s currency exchange rates in Nigeria present a nuanced picture, revealing insights into Black Market and Central Bank of Nigeria (CBN) rates as of December 4, 2023.

Best News Network has obtained the latest data, shedding light on the exchange rates for major currencies, including the highly sought-after US Dollar (USD), British Pounds (GBP), Euro (EUR), Canadian Dollar (CAD), and more.

Black Market Rates:

Dollar to Naira (USD to NGN)

- Buying Rate: ₦1,162

- Selling Rate: ₦1,165

As Nigerians navigate the currency market, the USD to NGN rates on the Black Market stand at ₦1,162 for buying and ₦1,165 for selling. This reflects the ongoing fluctuations influenced by the supply and demand dynamics in the market. The Black Market remains a preferred choice for many Nigerians, given the potentially higher conversion rates compared to traditional banking channels.

Quoting a financial analyst, “The Black Market often reflects the real-time sentiment of the market, responding swiftly to changes in economic conditions and demand for foreign currency.”

Pounds to Naira (GBP to NGN)

- Buying Rate: ₦1,455

- Selling Rate: ₦1,470

For those involved in transactions with British Pounds, the Black Market rates showcase ₦1,455 for buying and ₦1,470 for selling. These rates might experience slight variations across different parallel markets in Abuja, Kano, and Lagos.

Explaining the preference for the Black Market, a local trader states, “The flexibility and often better rates offered in the Black Market make it an attractive option for individuals and businesses engaged in foreign transactions.”

Euro to Naira (EUR to NGN)

- Buying Rate: ₦1,255

- Selling Rate: ₦1,275

Euro enthusiasts can observe the current Black Market rates at ₦1,255 for buying and ₦1,275 for selling.

A financial expert emphasizes, “Understanding the Euro to Naira rates is crucial for businesses engaged in international trade. These rates impact the cost of imports and exports, influencing overall economic activity.”

CAD to Naira (CAD to NGN)

- Buying Rate: ₦900

- Selling Rate: ₦950

Meanwhile, the Canadian Dollar sees rates of ₦900 for buying and ₦950 for selling on the Black Market.

Regarding the CAD to Naira rates, a market observer notes, “With global economic ties strengthening, monitoring rates for currencies like the Canadian Dollar is essential for businesses involved in international collaborations.”

Rand to Naira (ZAR to NGN)

- Buying Rate: ₦50

- Selling Rate: ₦65

In the case of the South African Rand, the Black Market rates are ₦50 for buying and ₦65 for selling.

Commenting on the Rand to Naira rates, an economist remarks, “The Rand’s position in the market reflects not only South Africa’s economic conditions but also Nigeria’s trade relations with the Southern African region.”

Ghanaian Cedi to Naira (GHS to NGN)

- Buying Rate: ₦85

- Selling Rate: ₦100

Ghanaian Cedis exchange at ₦85 for buying and ₦100 for selling on the Black Market.

An international trade specialist adds, “As Africa seeks increased intracontinental trade, monitoring the rates for currencies like the Ghanaian Cedi becomes crucial for fostering economic cooperation.”

CBN Official Naira Exchange Rates

The official exchange rates from the Central Bank of Nigeria (CBN) provide a contrasting perspective:

- 1 USD = ₦791.2516

The CBN rates, while more stable, serve as a benchmark for financial institutions and set the tone for the overall market sentiment. As of December 4, 2023, the official rate emphasizes the regulatory framework’s role in maintaining stability.

A financial consultant states, “CBN rates play a pivotal role in anchoring the broader financial market. They are instrumental in providing a foundation for businesses to plan their financial strategies.”

Factors Influencing Foreign Exchange Rates

Several factors contribute to the dynamics observed in the Black Market and CBN rates:

Inflation Rates

“Inflation directly impacts black market exchange rates. If the Nigerian economy can be stabilized and inflation is controlled, the naira will benefit,” notes an economic analyst.

Interest Rates

“Rising interest rates would harm the economy, causing it to contract and, as a result, the value of the naira to fall,” explains a financial expert.

Government Debt

“National debt can impact investor confidence and, as a result, the influx of funds into the economy. If inflows are high, the naira exchange rate will rise in favor of the naira,” states a fiscal policy analyst.

Speculators

“Speculators frequently impact the naira-to-dollar exchange rate. They stockpile money in anticipation of a gain, causing the naira to plummet even lower,” observes a market strategist.

Conditions of Trade

“Favorable trade terms will increase the value of the naira to the dollar, although Nigeria is currently experiencing a trade deficit,” comments an international trade specialist.